The future of financial services is looking increasingly automated, with TD Securities being the latest company to adopt artificial intelligence technology to enhance its equity sales and research teams. TD Securities’ ambitious move to infuse AI into its operational framework is aimed at accelerating the decision-making process, maximizing efficiency, and providing real-time insights.

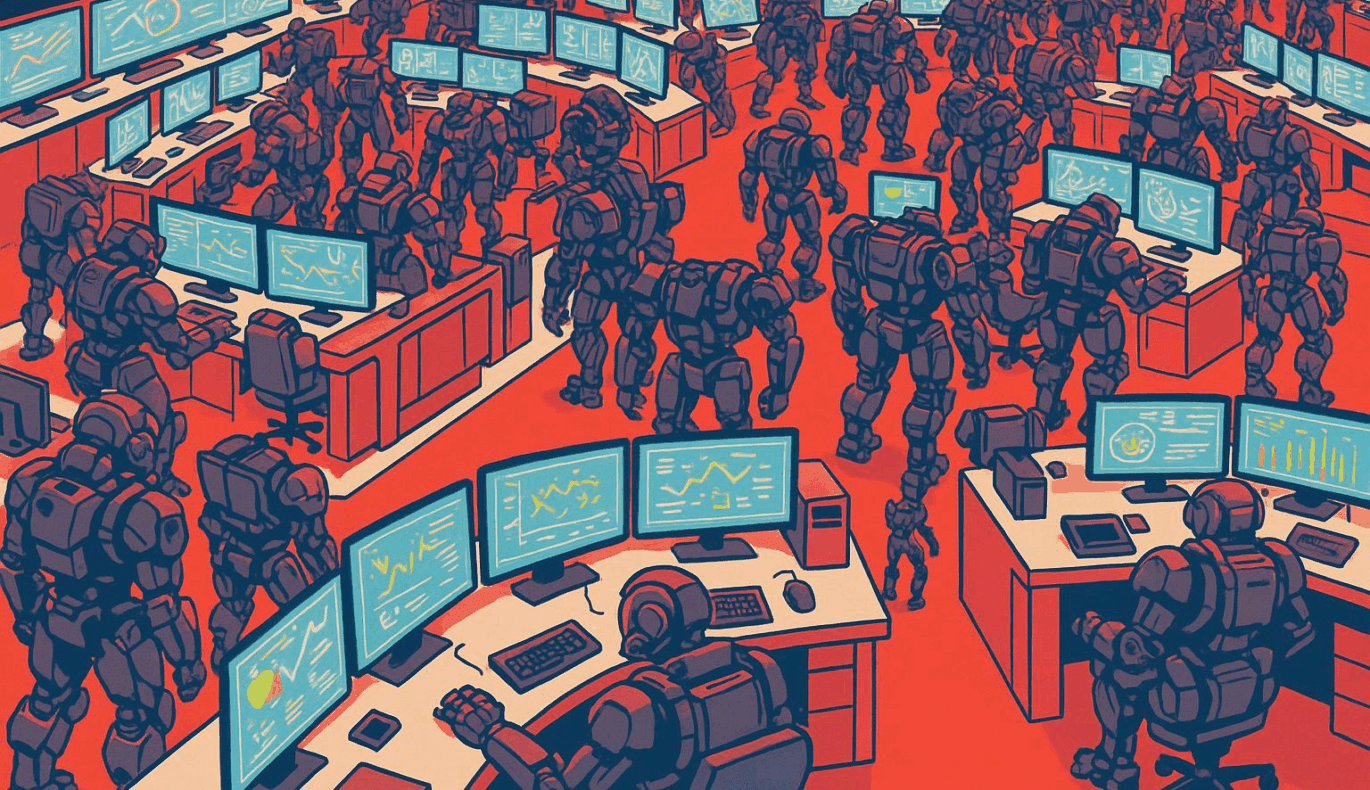

Collaborating with Layer 6 and OpenAI, TD is making strides in reshaping the traditional structure of a trading floor. The image of traders, immersed in screens filled with numbers and graphs, becoming overwhelmed with information is no longer a future concern. Instead, the AI assistant, armed with machine learning capabilities, can handle vast amounts of data at super-human speed, thereby liberating traders and analysts from the confines of information overload.

Transforming the Trading Floor Experience

The AI assistant promises a radical transformation of the trading floor experience. With its ability to identify, analyze, and interpret complex patterns and trends in a split of a second, the AI assistant can provide traders with up-to-the-minute market information. Additionally, it can predict how certain equities are likely to perform based on historical data and the current state of the market.

This approach to data management and trend prediction doesn’t only make decision-making quicker and more accurate but also enables analysts and traders to focus their energy and expertise on strategy development and client consultation, rather than on manual data analysis.

A Milestone in Financial Services Automation

TD Securities’ adoption of the AI assistant represents a significant milestone in the financial services industry’s long-standing trend towards automation. The financial landscape has changed dramatically over the past few decades, with banks and financial institutions continuously seeking ways to leverage technology for better efficiency, cost-effectiveness, and service delivery.

As various facets of banking become more complex, the necessity of solutions such as AI has become increasingly compelling. Investing in automated assistants and agents is poised to become a standard across the industry, enriching the banking environment with an amalgamation of human intuition and AI-driven analytics and insights.

In a sector marked by rapid and persistent changes, companies like TD Securities are leading the charge, demonstrating how technology can be harnessed to augment human capabilities, improve delivery of services, and ultimately deliver a better customer experience.

As AI becomes more deeply integrated within financial services, the interaction between human professionals and their AI counterparts will be a fascinating space to watch. However, as we look to the future, one thing is certain: the pathway to technological adoption in the financial sector will be paved with exciting and innovative developments that continue to redefine traditional operational structures.

Original article: here.